You are here: TSM SmartClient Menu Options > Transactions > Generic

_______________________________________________________________________________________________________

Generic transaction

The Generic transaction screen is used need more of a description here as to what types of reversal/corrections would be used for this transaction. Even a couple of examples would work.

How to access the

Generic transaction screen

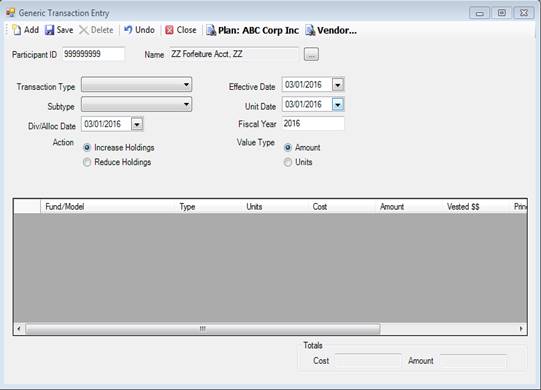

Click the Transactions menu, then select Generic. The Generic Transaction Entry screen appears.

How to perform a Generic transaction

The following should be used when you want to perform a generic transaction.

1. Choose the Plan.

2. Select or enter the participant.

3. Click Add.

4. Select the Transaction Type.

5. Enter the Div/Alloc Date.

6. Click either the Increase Holdings or Reduce Holdings radio button.

7. Enter the Effective Date, which is typically the current business date.

8. Enter the Unit Date, which is typically the current business date.

9. Enter the Fiscal Year the transaction is effective for.

10. Choose either the Amount or Units radio button.

11. Enter the loan number in the Loan ID field, if the LOANPY Transaction Type was chosen.

12. Choose the Fund/Model from the drop down.

13. Choose the source of money from the Type drop down.

14. Enter either the Units or the Amount in the appropriate column.

15. Enter the Interest, if the Interest column appears and applies to your transaction.

16. Click the Save.

Explanation of fields

If a field is not mentioned below, it is not currently used.

|

Field Name |

Field Description |

Required/ Optional |

|

Transaction Type |

The type of transaction you are entering. |

Required |

|

Div/Alloc Date |

The date used in determining the participant’s investment allocations. This date is also used in determining eligibility for dividends. |

Required |

|

Increase Holdings/Reduce Holdings |

Here you choose how the transaction is going to affect holdings, either to increase or reduce holdings. |

Required |

|

Effective Date |

The date the transaction will be traded. Typically this is the current business date. |

Required |

|

Unit Date |

The date the transaction will be traded. Typically this is the current business date. |

Required |

|

Fiscal Year |

The fiscal year that the transaction is effective for. |

Required |

|

Amount/Units |

Here you must choose if the transaction will be performed by a dollar amount, or by the number of units. Once chosen, you must then enter either a specific dollar amount or number of units for the investment and source indicated in the details box below. |

Required |

|

Loan ID |

This field only appears if the LOANPY transaction type was chosen. Here you enter the loan number that is affected for the transaction. |

Required if LOANPY was chosen on the Transaction Type |

|

Fund/Model |

The investment that is affected by the adjustment transaction. |

Required |

|

Type |

The source of money that is affected for the investment chosen. |

Required |

|

Units |

Enter the unit amount applicable to the corresponding investment. |

Required if Units was chosen as the Vaule Type |

|

Amount |

Enter the dollar amount applicable to the corresponding investment. |

Required if Amount was chosen as the Value Type |

|

Interest |

Enter the interest amount applicable to the fund type combination. This field only appears if the LOANPY transaction type was chosen. |

Required if LOANPY was chosen as the Transaction Type |

|

Principal |

This field will populate based on the Amount and Interest columns. |

Informational, if LOANPY was chosen as Transaction Type |

|

|

|

|

|

|

|

|

|

|

|

|