You are here:

Transactions > Loans

> Loan Repayments

_______________________________________________________________________________________________________________________________________

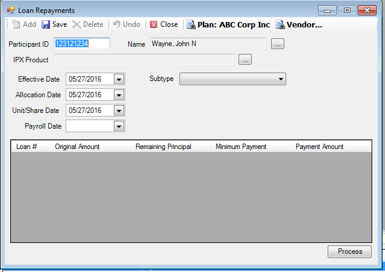

Loan Repayment Processing

You can use the Loan Repayments option to enter a loan repayment manually. If making an early loan payoff for a participant, the Allow Additional Principal checkbox must be selected on the Setup>Plans>Plan-Loan tab.

Show me how to access this option

Click Transactions, then Loans, then click Loan Repayments.

Show me the Loan Repayments window

Show me how to process a Loan Repayment

1) Confirm you are on the correct the Plan and search/select the participant, if needed.

2) Click the ellipsis (…) box next to IPX Product to select the product you are processing the loan payment for. Once you select the correct product, the participant’s loan information appears in the box below.

3) Enter the following dates:

a. Effective Date- the date the loan payment will be processed

b. Allocation Date- the date allocations will be effective, which is typically the same as the Effective Date

c. Unit/Share Date- the date the units/shares will be priced, which is typically the same as the Effective Date

d. Payroll Date- the date the loan payment is processed. This is not required.

4) Choose a Subtype from the drop down, if applicable.

5) Enter the payment amount in the Payment Amount column.

6) Click Process. A pending loan repayment transaction is created. Follow all other instructions for trading to finish processing the loan repayment transaction.

Explain the fields

|

Field Name |

Field Description |

Required/ Optional |

|

Effective Date |

The date the loan repayment will be processed |

Required |

|

Allocation Date |

The date the participant’s payment is to be invested. Typically the same as the Effective Date. |

Required |

|

Unit/share Date |

The date the unit/share price(s) that will be used in purchasing units/shares for the loan repayment, which is also typically the same as Effective Date. |

Required |

|

Payroll Date |

The date of the payroll that the repayment is associated. This may not be applicable depending on how the loan repayments are setup. |

Optional |

|

Subtype |

The subtype of the repayment, if applicable. This field is seldom used. |

Optional |

|

Loan # |

The loan number of the participant’s outstanding loan. |

Informational Only |

|

Original Amount |

The original amount of the participant’s loan, as displayed on the Loan Input screen. |

Informational Only |

|

Remaining Principal |

The remaining loan principal as of the participant’s last loan payment. |

Informational Only |

|

Minimum Payment |

The expected loan payment amount for the loan(s). |

Informational Only |

|

Payment Amount |

The amount of the payment that is being processed for this given transaction. A prepayment for the loan is only allowed if the Allow Additional Principal box is checked on the Setup>Plans>Plan-Loan tab. And an amount less than the loan payment amount is only allowed if the Allow Loan Repayment Less Than Scheduled Amount box is checked on the Setup>System>Control screen. |

Required |