Tax

Use the Tax option to establish and modify state and federal tax withholding information. TSM.Net will apply state withholding to payouts for participants residing in the states entered here. Note: To define the Federal Tax withholding amount, select Federal in the State list.

How to access this option

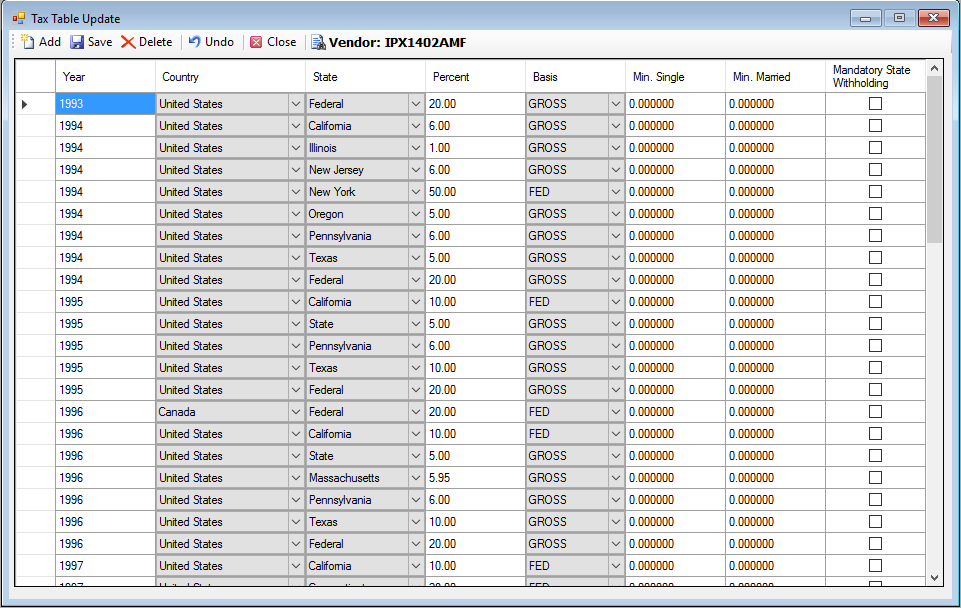

On the Setup menu, point to System, and then click Tax. The Tax Table Update window displays.

How to Add a Tax Record

1.

Click the ![]() icon. The cursor jumps to the bottom of the

page.

icon. The cursor jumps to the bottom of the

page.

2. TSM SmartClient automatically enters the current Year as the default. You can change the year by typing in the field.

3. United States is the default Country. To change the Country, select a different one from the list.

4. Select the State or “Federal” from the list. The default is Alaska.

5. Enter the tax rate (i.e. Percent) as a whole number, not as a percentage. For example, if the rate is 6%, enter 6.00. TSM SmartClient will convert it to a percentage.

6. Select Gross or Fed as the tax Basis.

7. Enter the minimum IRS-defined state tax percentage withheld for participants who are not married and married in the Min. Single and Min. Married fields, respectively.

8. Select the Mandatory State Withholding check box to require state taxes to be withheld for withdrawal and termination transactions.

9.

When you are done, click the ![]() icon. The following message displays:

icon. The following message displays:

Click OK.

10.To continue adding Tax Rates, repeat steps 1-9.

11.When you are done, click the ![]() icon.

icon.

How to Delete a Tax Record

1. Highlight the Tax record you want to delete.

2.

Click the ![]() icon. The following message displays:

icon. The following message displays:

Click Yes to delete it or No to retain it.

3. Click the ![]() icon to confirm the deletion. The following

message displays:

icon to confirm the deletion. The following

message displays:

Click OK.

4.

When you are done, click the ![]() icon.

icon.

5. If you are deleting more than one Tax record, repeat steps 1 and 2 for each. When you are done, proceed to steps 3 and 4.

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Year |

Enter the year on whic to base state or federal tax withholding amount. If no information is entered for a state for the year, TSM SmartClient will not withhold state taxes. TSM SmartClient defaults to the current year. The Third Party Administrator (TPA) is responsible for inputting the tax information at the beginning of each year. |

Required |

|

Country |

Select the country. Defaults to United States. |

Required |

|

State |

Select the state for which the tax rate will be applied or select “Federal”. |

Required |

|

Percent |

Enter the state tax rate or the mandatory federal tax withholding rate (20.00%) applied to distributions. Use a whole number; TSM SmartClient will convert it to a percentage and add the "%" symbol. Note: The IRS defines certain distribution types as eligible for rollover, while others they do not. Examples of the latter are refunds, required minimum distributions, and hardship withdrawals. Participants can then elect whether they wish to roll over a “rollover-eligible” distribution to an IRA or another qualified plan, whereas a participant election to roll over a hardship, refund or required minimum distribution is not allowed. If a participant chooses not to roll over their “rollover-eligible” distribution, the distribution will be subject to a mandatory federal tax withholding rate of 20%. A participant may further elect to withhold additional federal taxes, either as an additional dollar amount or as a higher percentage of her gross distribution. Since the federal tax withholding is mandatory, he cannot elect less than 20%. Conversely, distribution types not eligible for rollover are not subject to mandatory withholding. Rather, 10% federal taxes will be withheld, unless the participant elects some other amount. Since the federal tax withholding is not mandatory, he/she can elect less than 10%. However, refund distributions that are taxable in a prior tax year and certain de minimis amounts must not have any federal taxes withheld. TSM SmartClient uses these federal tax withholding rates as the default values on the Transactions > Distributions > Refund (Contributions) window and also processes refund transactions with the appropriate rate when system-generated refunds are created via the Compliance Processing module. |

Required |

|

Basis |

Choose either GROSS or FED from the list. This is used to determine how TSM SmartClient calculates the amount of state tax to be withheld, based either on the total (gross) amount of the distribution or on the amount withheld for federal tax purposes. Defaults to GROSS. |

Required |

|

Min. Single |

Enter the minimum IRS-defined state tax percentage withheld for participants who are not married. |

Optional |

|

Min. Married |

Enter the minimum IRS-defined state tax percentage withheld for participants who are married. |

Optional |

|

Mandatory State Withholding |

Select this check box to require state tax withholding for distribution transactions. |

Optional |