Tax 1099

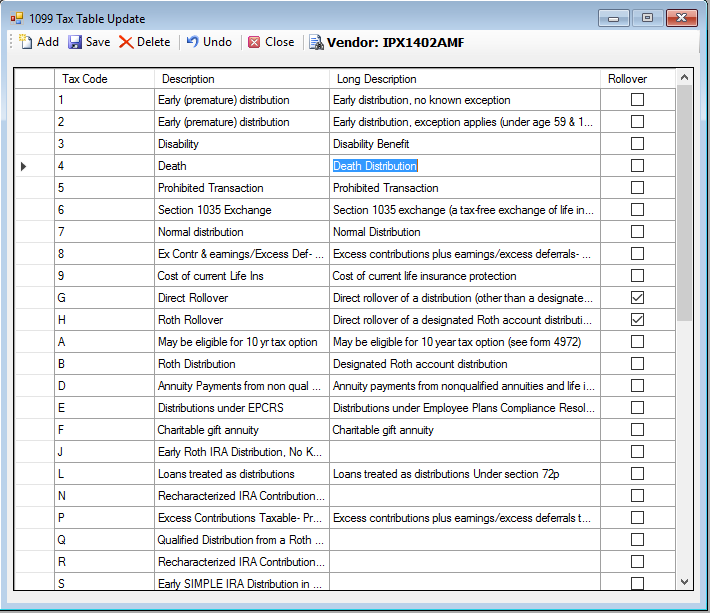

Use the Tax 1099 option to enter the Internal Revenue Service (IRS)-defined distribution codes that may appear in box 7 on Form 1099-R to report distributions from a retirement account. Distributions processed on due to a change in employment status; in-service withdrawals, including hardship withdrawals; certain deemed distributions; loan defaults; and corrective distributions [resulting from failed 402(g), ADP, ACP, or 415 tests] are all taxable events that must be reported to the IRS on the participant's 1099-R form. The Third Party Administrator (TPA) is responsible for entering any of the tax codes that apply to his plans on this window each year. Please also see and search: www.irs.gov.

Important Notes

Effective January 1, 2008, the IRS has added a new distribution code, "H," for Direct Rollover of a designated Roth account distribution to a Roth IRA. Note: The previous Code H for Direct rollover to qualified plan or tax sheltered annuity was deleted effective January 1, 2003 due to changes under Sections 641 and 642 of EGTRRA 2001. Therefore, please be sure that tax code "H" is reflected appropriately.

Effective January 1, 2006, the IRS requires separate reporting for distributions from Roth accounts and other types (non-Roth) of accounts. Use the tax code of B for Roth distributions and enter it here as a valid code for the Form 1099-R extract to work correctly.

allows one tax code per distribution transaction and subsequently extracts distribution information by tax code for purposes of the Form 1099-R Extract. To accommodate this, we suggest that you enter any combination code, such as 1L (Deemed Loan Distribution for a Participant under Age 59 1/2) or BG (Rollover of a Roth account) as a separate tax code, in addition to entering 1, L, B, and G as single codes.

How to Access this Option

On the Setup menu, point to System and then click Tax1099. The Tax 1099 Table Update window displays.

How to Add a Tax 1099 Code

1.

Click the ![]() icon.

icon.

2. Enter the 1099 Tax Code. The IRS supplies this code, which can be found each tax year on the Instructions for the Form 1099-R. Please also see and search: www.irs.gov.

3. Enter a Description of the code.

4. Enter a Long description. You can use the IRS description provided with each of its defined codes. You can also add comments in this field.

5. Select the Rollover check box if this tax code applies to rollover distribution transactions.

6.

When you are done, click the ![]() icon. The following message displays:

icon. The following message displays:

Click OK to close the dialog box.

7. To add additional codes, repeat steps 1 - 6.

8.

When you are done adding codes, click the ![]() icon.

icon.

How to Delete a 1099 Tax Code

1. Highlight the 1099 Tax Code Record you want to delete.

2.

Click the ![]() icon. The following message appears:

icon. The following message appears:

Click Yes to delete it or No to retain it.

3. To save the delete

action, click the ![]() icon. The following message appears:

icon. The following message appears:

Click OK to close the dialog box.

4. If you are deleting more than one 1099 Tax Code Record, repeat steps 1 and 2 for each record. When you are done, repeat Step 3 to save the changes.

5.

When you are done deleting codes, click the ![]() icon.

icon.

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Tax Code |

Enter the tax code. This code identifies how all distribution transactions are reported to the IRS on a participant's 1099-R form. These are the standard codes defined by the IRS. Enter any multiple code combinations, such as 1L or BG, here since TSM SmartClient assigns only one tax code per distribution transaction, with the exception of a 402(g) refund, where earnings are taxed differently from the excess. This field is limited to two (2) digits or characters. |

Required |

|

Description |

Enter a description corresponding to the entered tax code. You may add additional remarks in the Long Description field. |

Required |

|

Long Description |

Enter a long description of the tax code. |

Optional |

|

Rollover |

Select this check box if this tax code applies to the rollover (or direct transfer) of distributions. |

Optional |