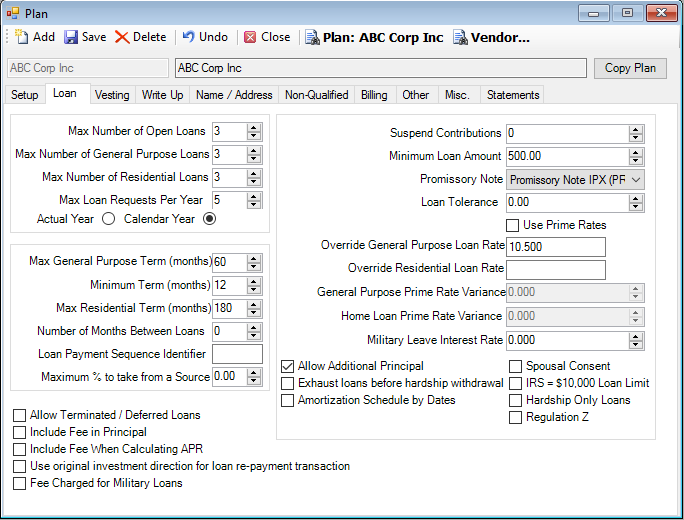

Plan - Loan tab

Use the fields on the Loan tab to define default Loans parameters for the plan. These are the guidelines for the plan's loan options. If a plan does not allow loans, all fields should be set to 0 or left blank. Please refer to the plan document and/or the plan's loan policy document for the various loan provisions established by the employer.

See Loan Grid - 8 Fee Profile Summary.xls to see how setting the flags will impact the loan modeling and processing options.

How to Access the Plan - Loan tab

1. On the Setup menu, point to Plans, and then click Plan.

2.

Click the Loan tab.

The Plan – Loan tab window displays.

How to Complete the Loan Parameters

1. If the plan allows loans, complete the following required fields. Otherwise, enter 0 (zero) in the field and a loan will not be able to be processed in the Plan.

· Enter the Maximum Number of Open Loans a participant may have.

· Enter the Maximum Number of General Purpose Loans a participant may have.

· Enter the Maximum Number of Residential Loans a participant may have.

· Enter the Maximum Loans Request Per Year a participant may initiate.

2. Select Actual Year if the period for loan requests per year is based on a twelve-month period or select Calendar Year if loan requests must be within the calendar year.

3. Enter the Maximum Term of the general purpose loan expressed in months. The number of months cannot exceed 60.

4. Complete any of the following optional fields:

· Enter the Minimum Term of the general purpose loan expressed in months.

· Enter the Maximum Term of the residential loan expressed in months. The number cannot exceed 360.

· In the Number of Months Between Loans field, enter the number of months required between a loan payoff and a new loan request and/or issue.

· Enter the Loan Payment Sequence Identifier to be used when importing allocations to be used for loan payments. This is done through conversion files. Create a separate contribution sequence using the Setup > Plans > Plan > Contribution Sequence option for this purpose and a profile using the Interfaces > Profile Maintenance > CONV ALLOC option for the loan payment allocation conversion. Once completed, you will see an allocation for the source LOANPY on the Setup>Participants>Investment Direction window.

· Enter the Maximum % to take from a source. This percentage will apply to all money sources and will minimize the probability of a loan transaction error during the posting process due to a depleted money source.

· Select the Allow Terminated / Deferred Loans check box to allow the terminated participant to continue to pay back outstanding loans. If it is not selected, loans for terminated participants should default according to the plan's loan policy.

· Select the Include Fee in Principal check box to include the loan fee in addition to the initial amount of the loan when calculating the Amortization schedule.

Note: The transaction rules for a loan fee must be established in the Setup > Transaction Rules > Transaction Fees option for the loan fee to be processed automatically at the time of the loan transaction.

· Select the Include Fee When Calculating APR check box to add the fee to the loan amount when calculating the APR on the promissory note.

· Select the Use original source allocations for loan payment transaction check box to direct TSM SmartClient to use the investment directions of the specific contribution sources that funded the loan. If that source does not have an investment direction, TSM SmartClient will use the SYSDEF allocation. In both cases, TSM SmartClient will use the investment direction in effect at the time of the loan repayment, which may or may not be the current allocation. Note: This is typically not the preferred setting. Most plans post loan repayments based on the investment direction currently in effect. This minimizes confusion on the participant's part and limits repayment failure due to fund closures or other investment lineup changes.

· Select the Fee Charged for Military Loans check box for the loan fee amount to appear in the Fee Amount field on the Transactions > Loans > Loan Input > Loan Adjustment tab when a loan is flagged as a military loan. The fee must be set up in the Setup > Transaction Rules > Transaction Fees option.

· In the Suspend Contributions field, enter the number of months a participant's contribution will be suspended if a loan is taken. This parameter will automatically populate the 'Suspend Contributions' date field on the Setup > Participants > Participant window when a loan is processed.

· Enter the Minimum Loan Amount in dollars allowed for a general purpose or a residential loan.

· Select the name of the Promissory Note you will be using from the list. Multiple promissory notes are available on TSM SmartClient for use, for example, Promissory Note, Promissory Note 50, Promissory Note AP2, Promissory Note APR, Promissory Note Penn, Promissory Note Starky. TSM SmartClient uses the promis.rtf as the default.

· Enter the dollar amount of Loan Tolerance TSM SmartClient will accept as reasonable to disregard as an outstanding balance. This should eliminate any small remaining balances that may occur. Note: We recommend that the Loan Tolerance be less than the amount of any single loan payment but not greater than $50.00.

· Select the Use Prime Rates check box to use the prime interest rate entered on the Setup > System > Control page for all plan loans.

· Enter the Override General Purpose Loan Rate uses a rate that differs from the default Loan Rate entered in the Setup > System > Control option. The value entered here will display in the 'Rate' field on the Transactions > Loans > Loan Input window. When a participant requests a loan over the VRU or Participant web site, TSM SmartClient will use this loan rate. If no rate is entered here, TSM SmartClient will use the default loan rate.

· Enter the Override Residential Loan Rate if the plan uses a rate that differs from the default residential loan rate entered in the Setup > System > Control option. The value entered here will display in the 'Rate' field on the Transactions > Loans > Loan Input screen. When a participant requests a loan over the VRU or Participant web site, this loan rate amount will be given. If no rate is entered here, TSM SmartClient will use the default residential loan rate.

· Enter an amount for the General Purpose Prime Rate Variance. TSM SmartClient uses this variance in conjunction with the Use Prime Rates function and the prime rate entered on the Setup > System > Control window for General Purpose loans.

· Enter an amount for the Home Loan Prime Rate Variance. TSM SmartClient uses this variance in conjunction with the Use Prime Rates option and the prime rate entered on the Setup > System > Control window for Principal Residency loans.

· Enter the Military Leave Interest Rate. Participants who are also active military personnel are entitled to special interest accrual caps (interest accrued may not exceed 6% during the military leave suspension period) while on military leave from work. This is in accordance with USERRA (Uniformed Services Employment and Reemployment Rights Act of 1994).

· Select the Allow Additional Principal check box to permit the user to pay additional principal in addition to the scheduled loan payment. Note: Selecting the Allow Loan Repayment Less Than Scheduled Amount (on Control page) and/or Allow Additional Principal check box(es) may throw off the amortization schedule if irregular payments are applied. This will require the TPA to be more vigilant about the repayment schedule. If you select both check boxes, the payroll system will reject any payment not equal to the amount originally specified. Loan pay-off requests can still be administered through the TSM SmartClient Generic Transaction function or the user can flip the plan settings and accept the payment through normal channels and then flip the settings back to minimize the impact of irregular payments.

· Select the Spousal Consent check box to require spousal consent when initiating a loan. When this check box is selected, the promissory note will include the appropriate wording for spousal consent. Spousal consent is only required for plans that are subject to Qualified Joint and Survivor Annuity rules. Please refer to your plan's document for further information.

· Select the Exhaust loans before hardship withdrawal check box to prohibit participants from taking hardship withdrawals until they have executed all loan possibilities.

· Select the IRS = $10,000 Loan Limit check box to allow the participant to take out a loan up to $10,000 if he has more than $10,000 fully vested, but not necessarily the full amount needed to usually borrow $10,000.

· Select the Amortization Schedule by Dates check box to change from the standard amortization schedule. The default is by amount of loan and number of payments remaining. If selected, the Amortization Schedule will display dates using the '1st Pmt Date' and the 'Payment Frequency' as set up in the Transactions > Loans > Loan Input option.

· Select the Hardship Only Loans check box to allow participants to take a loan for hardship purposes only. If selected, a participant will not be able to initiate or model a loan through either the Participant web site or the VRU. Note: The VRU and Internet will allow inquiries on existing loan balances.

· Select the Regulation Z check box to identify this plan as writing more than 25 participant loans in either the current or preceding calendar year. A plan that meets this criteria is subject to the general disclosure requirements of the Truth-in-Lending Act with regard to the 26th and any subsequent loans made during the year. Furthermore, if the plan, trust or trustee makes more than five mortgage loans during the year, it is subject to the same disclosure requirements [PL 90-321, Sec. 226.12(a)(17)]. The disclosure requirements, however, are not onerous. For that reason, the prudent administrator of any larger qualified plan may well want to include a "Truth in Lending Disclosure" as a part of its standard loan package.

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Maximum Number of Open Loans |

Enter the maximum number of outstanding loans a participant may have at any given time. |

Required if loans are permitted |

|

Maximum Number of General Purpose Loans |

Enter the maximum number of outstanding general purpose loans a participant may have at any given time. |

Required if loans are permitted |

|

Maximum Number of Residential Loans |

Enter the maximum number of outstanding principal residency loans a participant may have at any given time. |

Required if principal residency loans are permitted |

|

Maximum Loan Requests Per Year |

Enter the number of loans a participant may request during a year. A year can either be defined as a rolling year or a calendar year. If the plan allows a participant to have multiple loans (more than one) and there is a limit on how many loans can be taken in any year, you must select either Actual Year or Calendar Year. |

Required if multiple loans are permitted and there is a limit on how often a loan can be requested. |

|

Actual Year |

Select this option to allow the participant to take loans based on a twelve-month period. For example: If Loan #1 is issued on December 1, 2007, a second loan can not be requested until December 1, 2008. |

Required if loans are permitted and there is a limit on how often loans can be issued |

|

Calendar Year |

Select this option to allow the participant to take loans every calendar year. For example: If Loan #1 is issued on December 1, 2007, a second loan can be requested on January 1, 2008. |

Required if loans are permitted and there is a limit on how often loans can be issued |

|

Maximum General Purpose Term (months) |

Enter the maximum term of the general purpose loan length expressed in months. General purpose loans commonly are issued for a length of up to 5 years (60 months). |

Required if loans are permitted |

|

Min Term (months) |

Enter the minimum term of any loan length expressed in months. Some plan documents / loan policies state that a loan must be issued for a minimum of one year (12 months). |

Required if the plan states that a loan must be taken for a minimum number of months. |

|

Max Residential Term (months) |

Enter the maximum term of the principal residency loan length expressed in months. There is no maximum limit set by regulation for principal residency loans. However, a generally accepted fiduciary standard is that no loan term should extend past normal retirement age. The IRS opined unofficially in 2004 that the maximum term is what is "commercially reasonable." |

Optional |

|

Number of Months Between Loans |

Enter the number of months between a loan payoff date and the date of the next allowed loan request. This field works in conjunction to the 'Maximum Number of Open Loans' and 'Maximum Number of Open Loans Per Year' functions. Example:

The plan sets the following loan parameters: |

Optional |

|

Loan Payment Sequence Identifier |

Allows users to import, through conversion files, allocations to be used for loan payments. Users will need to create a separate contribution sequence using the Setup > Plans > Contribution Sequence option and a profile using the Interfaces > Profile Maintenance > CONV ALLOC window for the loan payment allocation conversion. Once completed, an allocation for the source LOANPY will be visible on the Transactions > Allocations window. (add link) |

Optional |

|

Maximum % to take from a source |

Enter the maximum percentage that can be withdrawn from each money source. This percentage will apply to all sources. This feature will minimize the probability of a Loan transaction error during the posting process due to a money source that was totally exhausted. Loans can be taken from sources elected by a participant (i.e. 100% pre-tax) to facilitate the repayment process. Alternatively, loans can be withdrawn from all sources on a pro-rated basis or they may be taken from a hierarchy of sources (1st after-tax, then pre-tax, etc.). Under each of these methods, no one source should be exhausted - it's either a manual process in which the user hardcodes the loan by money source or TSM SmartClient continues to withdraw from subsequent sources when previous sources are exhausted. This field seems to be unnecessary. Profiles and programming language can be used together to relieve TSM SmartClient of this additional calculation. |

Optional |

|

Allow Terminated/ Deferred Loans |

Select this check box to allow the terminated participant to continue paying back outstanding loans. If not, loans for terminated participants should be defaulted according to the plan's loan policy. |

Optional |

|

Include Fee In Principal |

Select this check box to process the loan fee in addition to the initial amount of the loan request. If not selected, the loan amount will be net of the fee. Note: You must establish the transaction rules for a loan fee in the Setup > Transaction Rules > Transaction Fees option for the loan fee to be processed automatically at the time of the loan transaction. |

Optional |

|

Include Fee When Calculating APR |

Select this check box to make the cost of the loan equal to interest on the loan plus the fee for the loan. |

Optional |

|

Use original source allocations for loan payment transactions |

If selected, TSM SmartClient will process loan repayment transactions to the specific contribution sources that funded the loan. If that source does not have an Investment Direction, TSM SmartClient will use the SYSDEF allocation. In both cases, TSM SmartClient will use the investment direction in effect at the time of the loan repayment. |

Optional |

|

Fee Charged for Military Loans |

If selected, the loan fee amount will appear in the 'Fee Amount' field on the Transactions > Loans > Loan Input > Loan Adjustment tab when a loan is flagged as a military loan. This amount is defined in the Setup > Transaction Rules > Transaction Fees option, (add link) |

Informational Only |

|

Suspend Contributions |

Enter the number of months a participant will not be allowed to submit contributions if he takes a loan. This will automatically populate the 'Suspend Contributions' date field on the Setup > Participants > Participant screen when a loan is processed. |

Optional |

|

Minimum Loan Amount |

Enter the minimum dollar amount allowed for a general purpose or a principal residency loan. |

Required if the plan states a minimum loan issuance amount |

|

Promissory Note |

Enter the name of the promissory note you will be using. Multiple promissory notes are available on TSM SMARTCLIENT for use, including the generic PROMIS and PROMIS1. To create custom promissory notes, contact Customer Services with your request. |

Optional |

|

Loan Tolerance |

Enter the amount that TSM SmartClient will accept as a reasonable amount to disregard as an outstanding balance. This field was designed to eliminate any small remaining balances that may occur. Note: We recommend that the Loan Tolerance be less than any single loan payment amount. |

Optional |

|

Use Prime Rates |

Select this check box to use the prime interest rate entered on the Setup > System > Control screen for all plan loans. If the loan interest rate is some variance of the prime rate, this check box should also be selected. |

Optional |

|

Override General Purpose Loan Rate |

Use this field if the plan uses a rate that differs from the default Loan Rate entered in the Setup > System > Control option. The value entered here will display in the 'Rate' field on the Transactions > Loans > Loan Input window. When a participant requests a loan over the VRU or Participant web site, TSM SmartClient will use this loan rate. If no rate is entered here, TSM SmartClient will use the default loan rate. |

Optional |

|

Override Residential Loan Rate |

Use this field if the plan uses a rate that differs from the default Loan Rate entered in the Setup > System > Control option. The value entered here will display in the 'Rate' field on the Transactions > Loans > Loan Input window. When a participant requests a loan over the VRU or Participant web site, TSM SmartClient will use this loan rate. If no rate is entered here, TSM SmartClient will use the default loan rate. |

Optional |

|

General Purpose Prime Rate Variance |

This field is used in conjunction with the 'Use Prime Rates' checkbox and the prime rate established on the Setup>System>Control window. The amount entered here allows for a plus or minus variance to the existing prime rate. |

Optional |

|

Home Loan Prime Rate Variance |

This field is used in conjunction with the 'Use Prime Rates' checkbox and the prime rate established on the Setup > System > Control screen. The amount entered here allows for a plus or minus variance to the existing prime rate. Home loan in field label should be changed to either residential or all residential labels should be changed to principal residency to conform with IRS and plan document defined terminology. |

Optional |

|

Allow Additional Principal |

Select this check box to allow additional principal to be paid, in addition to the scheduled loan payment. |

Optional |

|

Spousal Consent |

Select this check box if spousal consent is required in order to initiate a loan. The promissory note will include the appropriate wording for spousal consent. Spousal consent is only required for loans issued by plans subject to qualified joint and survivor annuity rules. |

Optional |

|

Exhaust loans before hardship withdrawal |

Select this check box to prohibit participants from taking hardship withdrawals until they have executed all loan possibilities. |

Optional |

|

IRS = $10,000 Loan Limit |

Select this check box to allow the participant to take out a loan of up to $10,000 if he has more than $10,000 fully vested, but not necessarily the full amount needed to usually borrow $10,000. |

Optional |

|

Amortization Schedule by Dates |

Select this check box to change from the standard amortization schedule. The default for showing a loan report is by amount of loan and number of payments remaining. If selected, the Loan Report will display the amortization schedule by dates using the '1st Pmt Date' and the 'Payment Frequency' as set up on the Transactions>Loans>Loan Input option. |

Optional |

|

Pay Interest to original money type |

Select this check box to allocate loan repayments to the original money sources of the loan. If not selected, TSM SmartClient will allocate loan repayment interest amounts to a system created source " INCOME" and the principal amounts to the original sources. |

Optional |

|

Hardship Loans Only |

Select this check box to allow participants to take a loan for hardship purposes only. If this box is checked, a participant will not be able to initiate or model a loan through either the Participant web site or the VRU. Note: The VRU and Internet will allow inquiries on existing loan balances. |

Optional |

|

Regulation Z |

Select the Regulation Z check box to identify this plan as writing more than 25 participant loans in either the current or preceding calendar year. A plan that meets this criteria is subject to the general disclosure requirements of the Truth-in-Lending Act with regard to the 26th and any subsequent loans made during the year. Furthermore, if the plan, trust or trustee makes more than five mortgage loans during the year, it is subject to the same disclosure requirements [PL 90-321, Sec. 226.12(a)(17)]. The disclosure requirements, however, are not onerous. For that reason, the prudent administrator of any larger qualified plan may well want to include a "Truth in Lending Disclosure" as a part of its standard loan package. |

Optional |