Setup Menu

_______________________________________________________________________________________________________

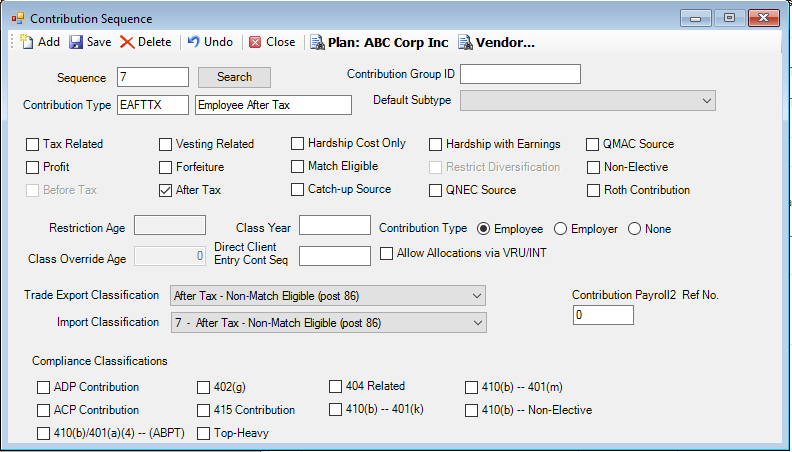

Contribution Sequence

Use the Contribution Sequence option to define the valid money sources for the plan, such as before-tax, match, and profit sharing. To ensure that functions to its fullest capacity, be sure to select all applicable fields for that specific money type. The impact of each of the fields is described in the Explanation of Fields section below.

In addition, the fields in the Compliance Classifications section are particularly important for discrimination testing. These flags determine which contribution types are considered in the various tests.

Loan Setup Requirement

Although contribution sequencing is not necessarily part of the loan setup requirements, if the plan offers loans, the user should order the contribution Sequences prudently as the loan takedown follows the sequence ordering as defined on this screen.

takes down loans Highest to Lowest and repays the reverse, Lowest to Highest. Money sources (contribution sequence numbers) for loans are exhausted High to Low, i.e., 30, 20, 10, etc., and repaid in the reverse, Low to High. This means that the highest sequence will be debited first to satisfy the loan request and then if needed additional contribution sequences will be debited until the loan request is satisfied. Loan repayments are credited back to the funds following the current investment directive on file and in the reverse contribution sequence as the original takedown.

How to Access the Contribution Sequence Window

On the Setup menu, point to Plans, and then click Contribution Sequence. The Contribution Sequence window displays.

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Sequence |

Enter a numeric ID (between 1 and 999) identifying the contribution types (money source). This ID is used to define the order in which loan transactions will be taken from participants' accounts. Loans will come from contribution types with the highest IDs first (i.e. 30, 20, 10). As for distribution transactions, TSM SmartClient takes them down from all sources on a pro rata basis. Alternatively, you can define transaction profiles to override these default hierarchies. |

Required |

|

Contribution Type |

Enter the money source identifier, up to six characters. This identifier will be used on many standard TSM SmartClient reports. Tab to the second field to enter a full description of the money source, up to 30 characters. Note: The full description may be truncated for reporting purposes. |

Required In addition, identify this type as Before Tax or After Tax by selecting the appropriate check box. |

|

Contribution Group ID |

This is a client specific field that allows you to group multiple sources. |

Optional |

|

Default Subtype |

Select the default subtype, if applicable. This is a client specific field which serves as an additional qualifier that is assigned to contribution transactions that are processed via the payroll interface files. Subtypes are defined in the Setup > System > Subtypes option. |

Optional |

|

Source Characteristics: Select all that apply |

||

|

Select this check box to designate this source as taxable. This calculates the taxable amount. Note: Earnings on Before Tax and After Tax contributions from this source may be taxable upon distribution. |

Optional In addition, select the Before Tax check box. |

|

|

Vesting Related |

Select this check box to indicate that the money type uses a vesting schedule. All money types defined as vesting related will be available in the Vesting Type list on the Setup>Plans>Vesting window. If not selected, this source is 100% vested. |

Optional |

|

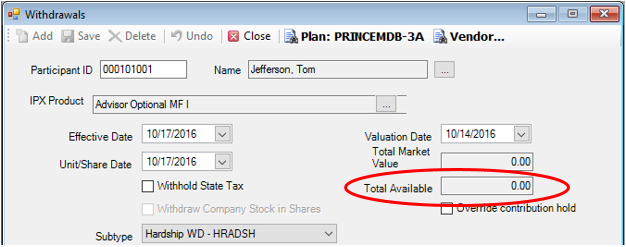

Hardship Cost Only |

Select this check box to include only the participant's deferred contribution when calculating the amount of hardship funds available. Earnings attributable to these contributions are not included in this amount. Note: The Internal Revenue Service (IRS) only permits the contributions (no gain/loss) of pre-tax deferral sources made after 12/31/1988 to be available for hardship and does not allow safe harbor contributions, QNECs, and QMACs made after 12/31/1988 in determining hardship availability. This option drives what appears

in the Total Available for Hardship Withdrawal field on the Transactions

> Distributions > Withdrawals window. |

Optional |

|

Hardship with Earnings |

Select this check box if the contributions and earnings to this money source should be included in the amount of hardship funds available. Note: The Internal Revenue Service (IRS) does not permit earnings on pre-tax deferral sources made after 12/31/1988 nor does it permit safe harbor contributions, QNECs, or QMACs made after 12/31/1988 when determining the amount available for hardship withdrawals. This option drives what appears

in the Total Available for Hardship Withdrawal field on the Transactions

> Distributions > Withdrawals window. |

Optional |

|

QMAC Source |

Select this check box to designate this contribution sequence as a Qualified Matching Contribution source. This source will display in the ACP Funds list on the Compliance Processing > Run Tests> ADP/ACP > Run ADP/ACP Test - Corrective Measures tab. Note: QMACs are not Vesting Related. They are always 100% vested. |

Optional If you select this check box, you should also select the Tax Related and Before Tax check boxes. |

|

Profit |

Select this check box if this is a profit sharing account. Note: If this is selected, contributions made to this source will post to a participant's account during a hardship suspension period. |

Optional If you select this check box, you should also select the Tax Related and Before Tax check boxes |

|

Forfeiture |

Select this check box to identify this source as the one to receive the allocated forfeiture. Note: Currently TSM SmartClient allows only one contribution sequence to be designated as forfeiture. |

Required Note: If a forfeiture contribution type is not specified, you will not be able to use the Forfeiture Allocation option. |

|

Match Eligible |

Select this check box if this contribution type is match eligible. Generally, match eligible sources are before tax, after tax, catch-up, and/or Roth contributions. |

Optional If Tiered Match Setup is defined, this source will be used as the basis for TSM.Net to calculate the match, via the Payroll File Interface, Individual Contribution, or Direct Client Entry options. |

|

Restrict Diversification |

Select this check box if there is an age restriction for this source. The details of such a restriction is often determined by the Plan Sponsor. Participants will be unable to reallocate these funds until they have reached the Restriction Age. In order to select this checkbox, the Use Diversification Restriction check box must be selected on the Setup > Plans > Plan - Other tab . |

Optional |

|

Non-Elective |

Select this check box to designate this contribution sequence as an Employer (non-matching) source. This source will be used in the Cross Testing compliance tests. |

Optional If you select this check box, you should also select the Tax Related and Before Tax check boxes. |

|

Select this check box to designate this source as before-tax. Note: Pre-tax employee deferral sources are not Vesting Related. They are always 100% vested. |

Required, if After Tax is not selected. If you select this check box, you should also select the Tax Related check box. |

|

|

Select this check box to designate this source as after-tax. Note: After-tax contribution sources are not Vesting Related. They are always 100% vested. |

Required, if Before Tax is not selected |

|

|

Catch-up Source |

Select this check box to designate this source as the catch-up source. According to the Internal Revenue Service (IRS), the catch-up eligible participant must be 50 years old by calendar year end. Participants under the age of 50 cannot contribute catch-up contributions. Note: Catch-up contributions are not Vesting Related. They are always 100% vested. |

Required if the plan offers catch-up contributions If you select this check box, you should also select the Tax Related and Before Tax check boxes, unless Roth Contribution is also selected. |

|

QNEC Source |

Select this check box to designate this contribution sequence as a Qualified Non-Elective source. This source will appear in the 'ADP Funds' list on the Compliance Processing > Run Tests > ADP/ACP > Run ADP/ACP Test - Corrective Measures tab. Note: QNECs are not Vesting Related. They are always 100% vested. |

Optional If you select this check box, you should also select the Tax Related and Before Tax check boxes. |

|

Select this check box to designate this contribution sequence as a Roth Contribution. If this check box is selected, select the After-tax check box also. Roth Contributions are not Vesting Related. They are always 100% vested. In addition, the Internal Revenue Service (IRS) considers them pre-tax deferrals for purposes of compliance testing (i.e. 402(g), ADP, 410(b), etc.) Note: For Form 1099-R tax reporting purposes, this field must be selected in order to determine the 1st year of Roth contributions, provided that any distribution from Roth accounts is coded with a tax code containing "B." Tax codes can be set up in the Setup > System > Tax1099 option. |

Optional |

|

|

Enter the restriction age for the contribution source. A participant will be unable to reallocate these funds until he reaches this age. Note: This field is only active and available in TSM.Net if the Use Diversification Restriction check box is selected on the Setup > Plans > Plan - Other tab . |

Optional |

|

|

Enter the class year for the current source. This is used to further clarify vesting. For each class year, you must also define a vesting schedule in the Vesting option. Note: In addition, select the Vesting Related check box and set the Import Classification to 1. |

Required, if the plan follows class year rules |

|

|

Contribution Type |

Select the party contributing the funds: Employee, Employer or None. |

Required for Premium Statements |

|

Class Override Age |

Enter the age at which a participant will automatically vest 100% for this source. Note: This field is used in conjunction with the Class Year. |

Optional |

|

Direct Client Entry Cont. Seq |

Enter the relative order in which this contribution type should appear on the Transactions > Contributions > Direct Client Entry window. Contribution sources used more frequently (every payroll) should be entered with a lower number than those contribution sources that are used less frequently (annually). If left blank, the sources will appear in alphabetical order, with any 'Loan Payment Sequence Identifier' appearing last. |

Optional |

|

Allow Allocations via VRU/INT |

Select this check box if Investment Directions and/or Account Transfers are allowed by the Contribution Source. TSM SmartClient will allow this feature to be activated for each source independently. Note: The Setup > Plans > Internet Setup > Participant Site must also be set up to allow Investment Directions and/or Transfers by source. |

Optional |

|

Trade Export Classification |

Select the trade export classification for each contribution type. You may assign the same classification for any number of contribution types for trade export. |

Optional |

|

Import Classification |

Select the classification to be used for importing conversion records and processing payroll files, using the Profile Maintenance option. When establishing a payroll profile, use the Import Classification that corresponds to the 'Name' on the Payroll Profile Maintenance window. When importing conversion holdings or allocation records, use the 'Conversion Reference No.' Note: TSM SmartClient will allow only one contribution sequence per classification type, unless "1 - None" is selected, which is unlimited. 'Import Classifications' can be changed to facilitate the importing of more than one amount to each classification. The 'Conversion Ref No.' must be added to data files prior to import. Additionally, various compliance tests use this field to determine the order in which the sources are depleted for refund transactions. For example, a non-matched before-tax source (#3) will be depleted before a matched before-tax source (#2) under the 402(g) test. |

Required for PAYROLL Interface and Compliance Processing Note: You are limited to 7 predefined sources. If your plan has more than 2 after tax sources, a profit sharing source, or a rollover source, you must use PAYROLL2 as your payroll interface profile. |

|

Contribution Payroll2 Ref No. |

Enter a number between 1 and 12 to be used as the 'Ref No.' for Payroll2 processing. The Contribution Payroll2 functionality allows you to import up to 12 sources of contributions including Profit Sharing, Rollover, Forfeiture and two additional after-tax sources. Note: The Payroll2 Interface must be set up through the Interfaces > Profile Maintenance option. |

Optional |

|

Compliance Classifications: Select one or more of the following compliance categories. TSM SmartClient uses these selections only for the Compliance Processing functions. |

||

|

ADP Contribution |

Select this check box to include these contributions in the plan's Actual Deferral Percentage (ADP) non-discrimination testing for the current year. Note: You cannot select both ADP Contribution and ACP Contribution. |

Required, if your plan is not safe-harbor and has a 401(k) feature or allows Roth contributions. |

|

ACP Contribution |

Select this check box to include these contributions in the plan's Actual Contribution Percentage (ACP) non-discrimination testing for the current year. Note: You cannot select both ACP Contribution and ADP Contribution. |

Required, if your plan is not safe-harbor and allows employer match or after-tax contributions. |

|

410(b)/401(a)(4) - (ABPT) |

Select this check box to include these contributions in the 401(a)(4) test, Average Benefit Percentage Test. |

Required, if your plan is a new comparability (cross-tested) plan, by design. |

|

402(g) |

Select this check box to include these contributions in the plan's 402(g) contribution limit for the current year. Note: Be sure before-tax deferrals, catch-up contributions, and Roth contributions are selected also. The 402(g) test verifies that the sum of these contributions do not exceed the 402(g) limit, reclassifies any excesses as catch-up and/or generates refund transactions (whichever is applicable based on the participant's age). |

Required, if your plan has a 401(k) feature or allows Roth contributions. |

|

415 Contribution |

Select this check box to include this source in the Section 415 test. Generally, all contribution sources except for Rollover are included in the 415 test. |

Required |

|

Top Heavy |

Select this check box to include this source in the Top Heavy test. Generally, account balances for all contributions sources except for Unrelated Rollover are included in the Top Heavy test. |

Required, if your plan is not safe-harbor or if your plan is safe harbor and makes employer contributions in addition to the safe-harbor contributions. |

|

404 Related |

Select this check box if this source is subject to 404 related limitations. Generally, all employer related (match, profit, non-elective) contribution sources are included the 404 test. |

Required, if your plan allows employer contributions. |

|

410(b) -- 401(k) |

Select this check box if this source is a pre-tax deferral, catch-up contribution, or Roth contribution. Note: Contributions falling under Section 401(k) of the Internal Revenue Code, including Roth contributions are tested together under the Section 410(b) test. |

Required, if your plan has a 401(k) feature or allows Roth contributions. |

|

410(b) – 401(m) |

Select this check box if this source is either an after-tax (non-Roth) or an employer match source, including safe harbor matching contributions (SHMACs) and QMACs. Note: Contributions falling under Section 401(m) of the Internal Revenue Code are tested together for purposes of the Section 410(b) test. |

Required, if your plan allows employer match or after-tax contributions. |

|

410(b) – Non-Elective |

Select this check box if this source is an employer non-matching source (i.e. non-elective, including safe harbor non-elective contributions (SHNECs), QNECs and profit sharing contribution). Non-elective (non-matching) employer contributions are tested together under the Section 410(b) test. |

Required, if your plan allows employer (non-matching) contributions. |