Setup MenuPlan

________________________________________________________________________________

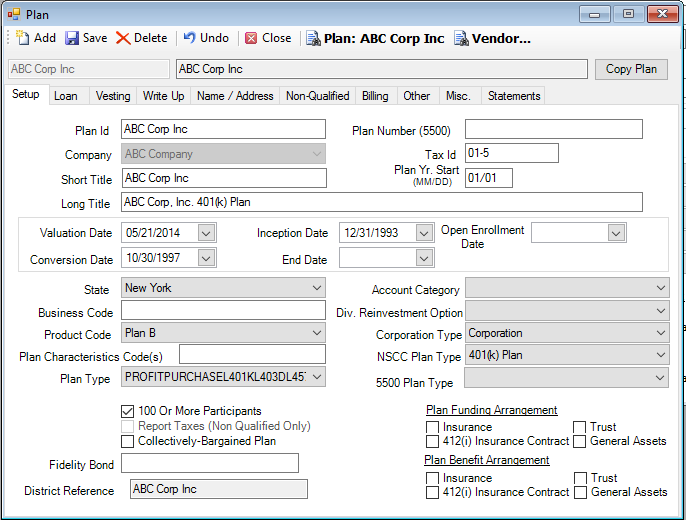

Plan - Setup tab

On the Setup tab you define basic information about a plan, such as the plan name, plan year start, Form 5500 identifying information, and plan type.

How to Access this Option

On the Setup menu, point to Plans, and then click Plan. The Plan – Setup tab displays.

How to Set Up a Plan

For further instructions on how to setup a plan, please click on the following link:

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Plan ID |

This is a unique code that identifies the plan. It can be a maximum of twelve alpha-numeric characters. |

Required |

|

Company |

The company is defined in the Setup > Plans > Company option. You can set up more than one plan with the same Company ID. Plans can be combined for reporting purposes and various compliance testing. |

Required |

|

Short Title |

This is an abbreviated version of the plan name, and it will print on several of the standard reports. You can enter a maximum thirty alpha-numeric characters. |

Required |

|

Long Title |

This is the full name of the plan as defined on the plan document. This name will print at the top of most standard participant statement formats. |

Required |

|

Tax Id |

This is the plan's tax identification number. This number will be used for all government reporting and filings. Typically, a plan has a tax identification number (TIN) that is different from the employer identification number (EIN) of the employer sponsoring the plan. Tax identification numbers are often established when the plan first becomes effective. An employer can complete Form SS-4 to obtain the number. If a plan does not have its own TIN, it is suggested that the plan sponsor obtain one. |

Optional |

|

Plan Yr Start (MM/DD) |

This is the first day and month for the start of the plan year (when the plan begins to count eligibility and vesting requirements for a given year). This typically correlates to the plan's corporate calendar. TSM SmartClient uses this field to determine the Fiscal Year to be used for payroll transactions and for Year to Date Contributions on participant statements. The plan year start can be found in the Definitions section of the plan document. |

Required |

|

Valuation Date |

This field displays the date of the last completed plan valuation. TSM SmartClient updates this field automatically when the unit/share values are entered into TSM SmartClient for the plan.

Note: For conversion plans, leave this field blank during plan setup. TSM SmartClient will automatically update the field when the conversion balances are loaded. The VRU and Internet use this field to determine which values to use for transactions and inquiry purposes. |

Optional |

|

Inception Date |

This is the plan inception date from the plan document. This is used for reporting purposes. TSM SmartClient also uses this date when determining Eligibility and Enrollment Dates during the Update Eligibility process and in determining excludable years of service for vesting purposes. The Form 5500 requires this information on Line 1c and is an item in the 5500 Extract on TSM SmartClient. |

Optional |

|

Open Enrollment Date |

This field contains the date any new eligibility requirement goes into effect (i.e. the effective date of any changes to the plan's eligibility rules that would generally grant more liberal requirements to the company's employees as of this date than to any future hires.) For example: An existing plan that was started with no service requirement might be amended to impose a one year of service rule, but current participants who do not satisfy the one year of service as of the "open enrollment date" (i.e. effective date of the amendment) will be grandfathered in for continued participation in the plan. |

Optional |

|

Conversion Date |

This is the first date the plan is administered on TSM SmartClient. This typically correlates to the last valuation date of the prior record keeper. |

Optional |

|

End Date |

This is the date the plan is removed from TSM SmartClient. |

Optional |

|

State |

This is the state in which the plan is registered. |

Optional |

|

Product Code |

This user-defined field is used to associate specific products with particular plans. For example, you may wish to track plans that have a GIC component, or you may wish to track plans that have IDA accounts. This field will be reflected on the Reports > Plan Setup Reports > Plan Setup report. Note: Products must be set up through the Setup > Systems > Products option. |

Optional |

|

Plan Type |

Plan Types are defined in the Setup > System > Plan Type option. Examples include 401(k), 403(b) or Profit Sharing. |

Optional |

|

NSCC Plan Type |

The NSCC is the National Securities Clearing Corporation. From the list, select the most appropriate NSCC plan type, such as 457 or 403(b). |

Required if Matrix is the Trading Partner, otherwise optional |

|

Requires Union Contractor Detail |

This check box is selected to identify a plan as a union plan that abides by Taft-Hartley provisions. (If you have selected Taft-Hartley as the Plan Type, TSM SmartClient automatically selects the Requires Union Contractor Detail check box.) If selected, you must identify the union contractor and pertinent dates associated with each contribution.

Note: The union contractor must first be defined on the Setup > Plans > Union Contractors screen. Participant contributions will be tracked by the union contractor. Each time you enter a contribution, the Union Contractor Detail dialog box will appear for completion. |

Required if plan requires union contractor detail |

|

100 or More Participants |

Select this check box to identify the plan as having 100 or more participants in the plan. Plans with 100 or more participants at the start of any plan year require the Schedule H to be completed when filing its Form 5500. |

Optional. This field is for information only |

|

Report Taxes (Non Qualified Only) |

Select this check box to identify the plan as a non-qualified plan, which is an employer-sponsored plan that does not meet the requirements of Section 401(a) of the 1954 Internal Revenue Code. If selected, taxes will be withheld when processing distributions. |

Optional |

|

Corporation Type |

This field identifies the corporation type for the plan. The options are Corporation, S Corp, Sole Proprietorship, Partnership, Tax Exempt Corp, Other, C-Corp, Government, Keogh, LLP, LLC, Non-Profit, Professional Association (P.A.), Professional Corporation (P.C.), and Public School |

Required |

|

Account Category |

The options for this field are Custodian - With no Statements, Custodian - with Statements, Non-Custody 401(k) Trading Only, Non-Custody Cash Settlement Account, Non-Custody Normal - Trading Only, Trustee No Statements, and Trustee With Statements. |

Required if Matrix is the Trading Partner, otherwise optional. |

|

Dividend Reinvestment Option |

There are eight (8) options comprised of both long-term gains and short-term gains. The long and short term gains can either be paid in cash or reinvested. |

Required if Matrix is the Trading Partner, otherwise optional |

|

Fields used in conjunction with the 5500 form |

||

|

Plan Number (5500) |

This is the number used on government filings. This number correlates to the number of plans a company has historically sponsored. Therefore, if this plan is the first one sponsored by the employer, the plan number is 001. Additionally, this three-digit number, in conjunction with the employer identification number (EIN), becomes a unique 12-digit number that the IRS, DOL, and PBGC use to identify the plan. Plan Number (5500) is required on Line 1b of the Form 5500 and is an item on the 5500 Extract on TSM SmartClient. |

Optional |

|

Business Code |

This is the six-digit code that best describes the nature of the plan sponsor's business. This code is required on the Form 5500 and therefore is suggested it is populated here. It will then be included in the 5500 Extract. A list of NCIS business codes can be found on the Form 5500 Instructions at www.irs.gov. |

Optional |

|

Plan Characteristics Code(s) |

This field can accommodate up to ten (10) feature codes. Each code contains two (2) characters. If this field is filled in, it will be included in the 5500 Extract. A list of Plan Feature codes is contained in the Instructions for Form 5500. |

Optional |

|

Collectively-Bargained Plan |

This check box is selected if the contributions to the plan and/or benefits paid by the plan are subject to the collectively-bargained process, even if only some of the employees covered by the plan are members of a collectively bargained unit. This information is for Box C of the Form 5500 and will be included in the 5500 Extract, if selected. |

Optional |

|

5500 Plan Type |

This field best describes the employer sponsoring the plan. The Form 5500 requires the plan to be identified as either a Multiemployer Plan, Single Employer Plan, Multiple-Employer Plan, or Direct Filing Entity (DFE). |

Optional |

|

Plan Funding Arrangement |

The "funding arrangement" is the method for the receipt, holding, investment, and transmittal of plan assets prior to the time the plan actually provides benefits. Please refer to the Form 5500 Instructions for further information. The options are Insurance, 412(i) Insurance Contract, Trust, and General Assets |

Optional |

|

Plan Benefit Arrangement |

The "benefit arrangement" is the method by which the plan provides benefits to participants. Please refer to the Form 5500 Instructions for further information. The options are Insurance, 412(i) Insurance Contract, Trust, and General Assets |

Optional |