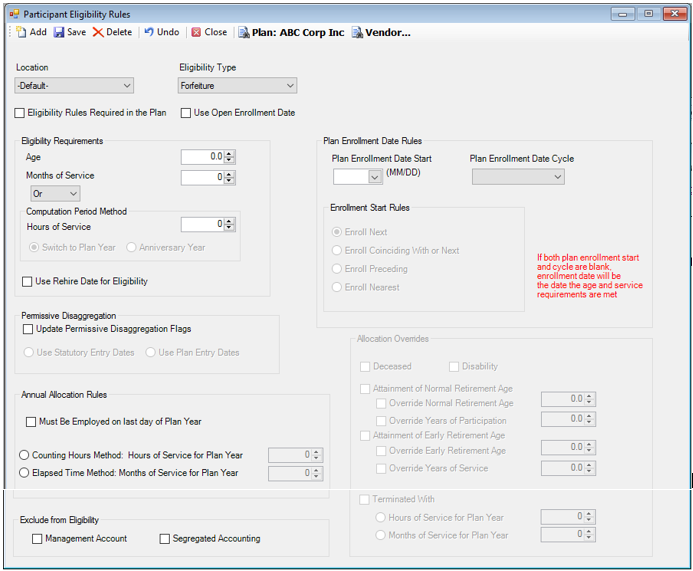

Setup MenuParticipant Eligibility Rules

Participant Eligibility Rules - Forfeiture

These rules define when a participant is eligible to receive a forfeiture allocation or credit.

How to Access the Participant Eligibility Screen

On the Setup menu, point to Plans and then click Participant Eligibility Rules. The Participant Eligibility Rules window displays.

How to Define Eligibility Rules for Forfeiture

1. Leave Location as -Default-, unless a different set of eligibility rules need to be defined for each location of the Plan. Skip to step 14 to define eligibility rules for a specific location. Otherwise, continue to step 2.

2. Select Forfeiture as the Eligibility Type.

3. Select the Eligibility Rules Required in the Plan check box to require eligibility rules for forfeiture eligibility.

4. Select the Use Open Enrollment Date check box to grandfather existing Plan participants if there are amendments to the Plan eligibility requirements. Note: An Open Enrollment Date must be entered first on the Setup>Plans>Plan - Setup tab before selecting this check box. If a date is not entered, the eligibility rules cannot be saved.

5. Select the Eligibility Requirements:

Age: Enter the minimum age required to receive a forfeiture allocation. The default is 0 and the maximum is 21.

Months of Service: Enter the number of months a participant must be employed to be considered eligible to receive a forfeiture allocation. The default is 0 and the maximum is 24. Note: The hire date is entered in the Setup>Participants>Employment Dates option.

And/Or: Select "And" if a minimum number of Hours is required in addition to months of service. Select "Or" if a minimum number of Hours is required as an alternative to months of service.

6. Select Computation Period Method and Hours of Service.

Hours of Service: Enter the number of hours that a participant must complete before he becomes eligible to receive a forfeiture allocation. Hours of service information must be defined in the Setup>Participants>Payroll Detail option.

Choose either Switch to Plan Year or Anniversary Year.

7. Use Rehire Date for Eligibility: Select this check box to calculate eligibility based on the participant's rehire date, if applicable. If this check box is selected, the Use Break in Service check box must be selected on the Setup>Plans>Plan - Vesting tab and you must define the Setup>Plans>Break in Service Rules.

8. Select Plan Enrollment Date Rules.

Plan Enrollment Date Start (MM/DD): Enter the Month and Day on which eligible participants will be able to enroll in the Plan. This field is generally set to the first day of the Plan year and is used in conjunction with the Plan Enrollment Date Cycle field and the Enrollment Start Rules options. For example, if a participant is eligible as of 05/24/2007 and you enter 01/01 (with Monthly as the cycle frequency and Enroll Next as the Enrollment Start Rules option), the participant's Eligibility Date will be 06/01/2007.

Plan Enrollment Date Cycle: Select the frequency (Monthly, Quarterly, etc.) in which an eligible participant can enroll. This field is used in conjunction with the Plan Enrollment Start (MM/DD) field and the Enrollment Start Rules options. For example, if a participant is eligible as of 05/24/2007 and you select Monthly (with 01/01 as the Plan Enrollment Start date and Enroll Preceding as the Enrollment Start Rules option), the participant's Eligibility Date will be 05/01/2007.

9. Select one of the Enrollment Start Rules options: Enroll Next, Enroll Coinciding with or Next, Enroll Preceding, or Enroll Nearest.

For example, if the Plan is a calendar year Plan with monthly

entry and the date, age and service met are on 2/1/2006, the Enrollment Date

will be:

Enroll Next: 3/1/2006

Enroll Coinciding With or Next: 2/1/2006

Preceding Enrollment Start: 1/1/2006

Enroll Nearest: 2/1/2006

10.Select the Exclude from Eligibility options, which are used for excluding categories of participants from the Plan.

Management Account: Select this check box to exclude any participants that are flagged as Management Accounting on the Setup>Participants>Participant Plan Other Information - Flags tab.

Segregated Accounting: Select this check box to exclude any participants that are flagged as Segregated Accounting on the Setup>Participants>Participant Plan Other Information - Flags tab.

11.Specify the Annual Allocation Rules, which are additional criteria required to determine whether a participant is eligible to receive a forfeiture allocation. Choose all that apply.

Must be Employed on the Last Day of Year: Select this check box if the Plan requires the participant to be employed on the last day of the Plan Year to be eligible.

Months from Plan Year: Enter the number of months a participant must be employed in the current Plan year to be eligible. The default is 0.

Hours of Service For Plan Year: Enter the number of hours that a participant must work during the Plan year before he becomes eligible to receive a forfeiture allocation.

12.Select any Allocation Overrides:

Deceased, Disabled, Retired: Select all that apply.

Use Normal Retirement Age Override: Select this check box to override the normal retirement age specified on the Setup>Plans>Plan - Vesting tab. Enter the Override Normal Retirement Age.

Use Early Retirement Age Override: Check this box to override the early retirement age specified on the Setup>Plans>Plan - Vesting tab. Enter the Override Early Retirement Age.

13.Click the Add icon to access the Select Location and Eligibility Type dialog box to add rules for a specific Location. Repeat Steps 2-13.

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Location |

The field is automatically populated with a -Default- location. Alternatively, a Plan-specific location code can be added to define rules for certain groups of employees or regions. A location can only be added if there are locations defined in the Plan. Note: You can set different eligibility rules for each location in the same Plan. |

Optional |

|

Eligibility Type |

Select Forfeiture. |

Required, if the Plan allocates forfeitures to Plan participants |

|

Eligibility Rules Required in the Plan |

Select this check box to define the eligibility rules. |

Required, if the Plan allocates forfeitures to Plan participants |

|

Use Open Enrollment Date |

Select this check box for TSM SmartClient to calculate enrollment dates using the open enrollment date. The open enrollment feature allows an employer to grant more liberal eligibility requirements to its current employees than to its future hires. Note: An Open Enrollment Date must be entered first on the Setup>Plans>Plan - Setup tab before selecting this check box. If a date is not entered, the eligibility rules cannot be saved. |

Optional |

|

Eligibility Requirements: The following fields are used to determine how a participant is deemed eligible for the Plan. |

||

|

Age |

Enter the minimum age required to receive a forfeiture allocation. |

Required, if the Plan defines a minimum age. |

|

Months of Service |

Enter the number of months a participant must be employed, from their date of hire, to be considered eligible to receive a forfeiture allocation. The default is 0. Note: The hire date is set in the Setup>Participants> Employment Dates option. |

Required, if the Plan defines service as a minimum number of months. |

|

And/Or |

Enter "And" when hours are required in addition to months of service. Enter "Or" when hours are required as an alternative to months of service. |

Required, if the Plan defines service in terms of hours. |

|

Use Rehire Date for Eligibility |

Select this check box for TSM SmartClient to calculate eligibility based on the participant's rehire date, if one exists. If selected, the Use Break in Service check box must be selected on the Setup>Plans>Plan - Vesting tab and the Break in Service Rules must be defined. |

Optional |

|

Computation Period Method: These options determine how hours are counted during each period of service. |

||

|

Hours of Service |

Enter the number of hours that a participant must complete before he is eligible to receive a forfeiture allocation. Hours of service information must be entered in the Setup>Participants>Payroll Detail option. |

Required, if the Plan defines service in terms of hours. |

|

Switch to Plan Year |

Select whichever method the Plan defines as the computation period method. |

Required, if the Plan defines service in terms of hours. |

|

Plan Enrollment Date Rules: These fields determine how the participant's Eligibility Date is calculated. |

||

|

Plan Enrollment Date Start (MM/DD) |

Enter the Month and Day on which eligible participants will be able to enroll. This field is used in conjunction with the Plan Enrollment Cycle field and the Enrollment Start Rules options. For example, if a participant is eligible as of 05/24/2007 and you enter 01/01 (with Monthly as the cycle frequency and Enroll Next as the Enrollment Start Rules option), the participant's Eligibility Date will be 06/01/2007. |

Required, if the Plan defines entry dates. |

|

Plan Enrollment Date Cycle |

Enter the frequency (monthly, quarterly, etc.) in which an eligible participant will be able to enroll. This field is used in conjunction with the Plan Enrollment Start (MM/DD) field and the Enrollment Start Rules options. For example, if a participant is eligible as of 05/24/2007 and you select Monthly (with 01/01 as the Plan Enrollment Start date and Enroll Preceding as the Enrollment Start Rules option), the participant's Eligibility Date will be 05/01/2007. |

Required, if the Plan defines entry dates. |

|

Eligibility Start: Select one of the following options. |

||

|

Enroll Next |

Select this option to make a participant's Eligibility Date the next available Enrollment Date. |

Required, if the Plan defines entry dates. |

|

Enroll Coinciding with or Next |

Select this option to make a participant's Eligibility Date the date coinciding with the Eligibility date or the next available Enrollment Date, whichever is earlier. |

Required, if the Plan defines entry dates. |

|

Enroll Preceding |

Select this option to make a participant's Eligibility Date the preceding Enrollment Date. |

Required, if the Plan defines entry dates. |

|

Enroll Nearest |

Select this option to make a participant's Eligibility Date the nearest Enrollment Date. |

Required, if the Plan defines entry dates. |

|

Exclude from Eligibility |

||

|

Management Account |

Select this check box to exclude any participants from the eligibility process that are flagged as Management Accounting on the Setup>Participants>Participant Plan Other Information - Flags tab. |

Optional |

|

Segregated Accounting |

Select this check box to exclude any participants from the eligibility process that are flagged as Segregated Accounting on the Setup>Participants>Participant Plan Other Information - Flags tab. |

Optional |

|

Annual Allocation Rules: These options are additional criteria required to determine whether a participant is eligible to receive a forfeiture allocation. Select all that apply. |

||

|

Must Be Employed on the Last Day of Year |

Select this check box if the Plan required the participant to be employed on the last day of the Plan Year to be eligible. |

Required, if the Plan defines allocation rules |

|

Months from Plan Year |

Enter the number of months a participant must be employed in the current Plan year to be eligible. The default is 0. |

Required, if the Plan defines allocation rules |

|

Hours of Service for Plan Year |

Enter the number of hours that a participant must work during the Plan year before he becomes eligible to receive a forfeiture allocation. |

Required, if the Plan defines allocation rules |

|

Last Year of Service Rule: Select only one. |

||

|

Months from Plan Year Start to Termination Date |

Enter the number of months from the Plan year start a participant must complete before being eligible to receive a forfeiture allocation. |

Required, if the Plan defines allocation rules |

|

Months from Calendar Year Start to Termination Date |

Enter the number of months from the calendar year start a participant must complete before being eligible to receive a forfeiture allocation. |

Required, if the Plan defines allocation rules |

|

Hours of Service for the Plan Year |

Enter the number of hours from the Plan year start a participant must complete before being eligible to receive a forfeiture allocation. |

Required, if the Plan defines allocation rules |

|

Allocation Overrides: These options (when selected) override specific Annual Allocation Rules |

||

|

Deceased, Disabled, Retired |

Select any of these check boxes to deem participants as eligible if they meet any of the specified overrides during the Plan year. You must enter the appropriate dates on the Setup>Participants>General Information - Dates tab. |

Required, if the Plan defines allocation overrides. |

|

Use Normal Retirement Age Override |

Select this check box to override the normal retirement age specified in the Setup>Plans>Plan - Vesting tab. Enter the Override Normal Retirement Age. |

Required, if the Plan defines normal retirement age override for allocation purposes. |

|

Use Early Retirement Age Override |

Select this check box to override the early retirement age specified on the Setup>Plans>Plan - Vesting tab. Enter the Override Early Retirement Age. |

Required, if the Plan defines early retirement age overrides for allocation purposes |