Setup Menu

_______________________________________________________________________________________________________

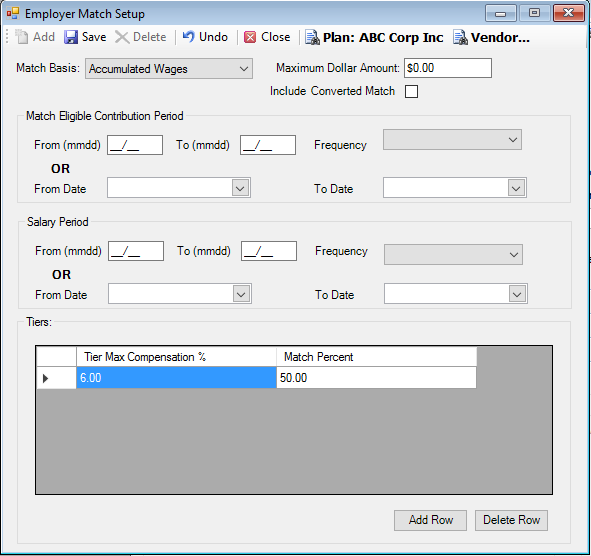

Employer Match Setup

Use the Employer Match Setup option to define the Plan's matching formula, as stated in its Plan document. This option also accommodates tiered match formulas. All tiers are defined as a percentage of a specific match basis (Salary and Accumulated Wages) and allows TSM SmartClient to create employer match contributions (CONT) transactions for match eligible participants.

Note: Plan documents define matching formulas as either discretionary or non-discretionary. Non-discretionary formulas will state whether the Plan caps the dollar amount an individual participant can receive as a matching contribution. For discretionary formulas, the Plan Sponsor cannot only impose a dollar limit, he/she can also change the formulas periodically (i.e., annually, mid-year, etc.). You should receive written confirmation if the Plan Sponsor amends the Plan document or operationally changes the match formula (including the maximum match dollar amount, if applicable), and make the changes here.

The Contribution options (Individual, Direct Client Entry and Employer Match Transactions), as well as the Payroll import and Conv-Cntrb import processes, base the match contributions on the information entered here.

For some Plans, the rate of match on each tier is determined annually at the employer's discretion. If a Plan includes an employee after-tax contribution, the matching contribution formula might apply to only the elective deferrals, to only the employee after-tax contributions, or to both types of contributions.

Important Information

Before entering the tiered match, you must define at least two contribution types in the Contribution Sequence option. The first must be an employee source that is match-eligible and the second an employer match source.

In order to receive a Match contribution, a participant must meet the eligibility and allocation requirements as specified in the Participant Eligibility Rules option. You can verify that he or she has met the requirements by confirming that the Match Eligibility Date, Match Allocation Date and the Match Eligible check box are all populated on the Setup > Participants > Participant Plan Other Information - Eligibility tab.

Be sure the salary or payroll detail information contains current salary information, depending on which 'Match Basis' is selected, in the Setup > Participants > Salary option.

If the Include Converted Match check box is selected, TSM SmartClient will take into consideration any contributions listed in the Setup > Participants > Converted Transactions option when it calculates the match contribution.

The Employer Match Setup option impacts the following options:

· Salary

· Payroll Interface (Import)

How to Access the Employer Match Setup Screen

On the Setup menu, point to Plan, and then click Employer Match Setup. The Employer Match Setup window displays.

How to Setup a Tiered Match

1. Select the Plan.

2. Select the match basis from the drop down list to use in the calculation. The available types are: Salary and Accumulated Wages. This is a required field.

If salary is selected, please skip steps 10-14.

Note: You will find the definition of compensation used in calculating an employer matching contribution in the Plan's document. Please refer to this document prior to selecting the match basis.

3. Enter the maximum dollar amount available for the Plan. This is a required field. If the Plan does not have a stated maximum dollar amount, this field should be set to the dollar amount that results when the Plan's matching formula is applied to the IRS 401(a)(17) limit. For example, if the match formula is 100% up to the 1st 3% of pay, then for the 2007 Plan year, the match would be maximized at $6,750. This limit appears on the Tiered Match Plan Setup report.

4. Select the Include Converted Match check box to include converted match money.

5. Enter the month and day for the beginning of the period for which you are calculating the match.

6. Enter the month and day for the end of the period for which you are calculating the match.

7. Select the frequency of the matching contribution being calculated.

OR, in lieu of Steps 5-7,

please see Steps 8-9

8. Enter the start date for the period for which you are calculating the match.

9. Enter the end date for the period for which you are calculating the match.

If Accumulated Wages is selected as the match basis, please complete steps 10-14.

10.Enter the month and date for the beginning of the payroll period for which you are including payroll wages.

11.Enter the month and day for the end of the payroll period for which you are including payroll wages.

12.Select the frequency of the payroll wages being used to calculate the matching contribution.

OR, in lieu of Steps 10-12, please see Steps 13-14:

13.Enter the start date for the period in which you are including the payroll wages.

14.Enter the end date for the period in which you are including payroll wages.

15.Enter the percentage of compensation to be used in the Tier Max Compensation % field. The total match cannot exceed the dollar amount that is calculated from the percent entered. This is a required field.

Note: Compensation considered in the formula cannot exceed the Internal Revenue Code Section 401(a)(17) limit. This limit varies by year and must be entered in the Max Salary Amount column on the Setup > System > window.

16.In the Match Percent field, enter the percentage of match eligible contributions that the company will match. This is a required field.

Example for Items 15 and 16:

The Plan's document states the matching formula is non-discretionary and is equal to 50% up to the first 6% of compensation. Therefore, the Tier Max Compensation % field = 6.00% and the Match Percent field = 50.00%.

17.If there is more than one tier, click Add Row and enter additional percents for compensation and match. Note: Additional percents of compensation must reflect the cumulative percentage amount.

For Example: A Plan is designed as a safe harbor Plan using the basic safe harbor matching (SHMAC) formula, 100% of the 1st 3% of compensation and 50% of the next 2% of compensation. Therefore, this Plan will reflect two (2) tiers (or rows) on this screen.

Tier 1: Tier Max Compensation = 3.00% and Match Percent field = 100.00%

Tier 2: Tier Max Compensation = 5.00% and Match Percent field = 50.00%

18.If you need to delete a row, select it and then click Delete Row.

19.When you are done, click the Save icon. The following message displays:

Click OK.

Explanation of Fields

|

Field Name |

Field Description |

Required / Optional |

|

Match Basis |

Select the match basis to use in the calculation for this tier from the list. The available types are: · Salary · Accumulated Wages |

Required |

|

Maximum Dollar Amount |

Enter the maximum dollar amount allowed by the Plan. If the Plan does not have a stated maximum dollar amount, this field should be set to the dollar amount that results when the Plan's matching formula is applied to the IRS 401(a)(17) limit. For example, if the match formula is 100% up to the 1st 3% of pay, then for the 2007 Plan year, the match would be maximized at $6,750. This limit appears on the Tiered Match Plan Setup report. |

Required |

|

Include Converted Match |

Select this check box to include converted match money. |

Optional |

|

Match Eligible Contribution Period |

||

|

From (mm/dd) |

Enter the month and day for the beginning of the payroll period for which matching contributions are being calculated. |

Required if From Date is not selected |

|

To (mm/dd) |

Enter the month and day for the end of the payroll period for which matching contributions are being calculated. |

Required if To Date is not selected |

|

Frequency |

Select the payroll period frequency. |

Required if From Date and To Date are not selected |

|

From Date |

Enter the start date for the period for which matching contributions are being calculated. |

Required if From (mm/dd) is not selected |

|

To Date |

Enter the end date for the period for which matching contributions are being calculated. |

Required if To (mm/dd) is not selected |

|

Salary Period: Determines the Period Used when Accumulated Wages is selected. |

||

|

From (mm/dd) |

Enter the month and day for the beginning of the payroll period in which you are including payroll wages. |

Required if From Date is not selected |

|

To (mm/dd) |

Enter the month and day for the end of the payroll period in which you are including payroll wages. |

Required if To Date is not selected |

|

Frequency |

Select the frequency of payroll wages to be used. |

Required if From Date and To Date are not selected |

|

From Date |

Enter the start date for the period for which you are including payroll wages. |

Required if From (mm/dd) is not selected |

|

To Date |

Enter the end date for the period for which you are including payroll wages. |

Required if To (mm/dd) is not selected |

|

Tiers |

||

|

Tier Max Compensation % |

Enter the percent of the maximum compensation amount based on the Match Basis chosen. The total match cannot exceed the dollar amount that is calculated from the percent of compensation entered. Compensation considered in the formula cannot exceed the Internal Revenue Code Section 401(a)(17) limit. This limit varies by year and must be entered in the Max Salary Amount column in the Setup > System > option. To add a second tier, click the Add Row button at the bottom of the window. |

Required |

|

Match Percent |

Enter the percentage of match eligible contributions that the company will match. |

Required |

Example of a Tiered Match Formula

|

Matching contribution formula (Employer formula) is 100% of elective deferrals up to 2% of compensation, 50% of the next 2% of compensation deferred and 25% of the next 2% of compensation deferred. Let's say a participant's compensation is $50,000. Each tier is defined in 2% increments of the participant's compensation, or $1,000 increments. Under the formula, the participant is entitled to a matching contribution of 100% on the first $1,000 deferred, 50% on the next $1,000 deferred and 25% on the third $1,000 deferred. The participant's deferral is $2,500. The employer would match 100% (or $1,000) on the first $1,000, 50% (or $500) on the second $1,000 and 25% (or $125) on the last $500. The allocation formula would require the administrator to allocate a total of $1,625 of the employer's matching contribution to the participant's account to reflect his share of matching contributions. |